Amazon's success as a digital trading platform has made the brand one of the most valuable in the world. But in more and more product categories, Amazon is no longer just a powerful retailer, but also a direct competitor for brand owners. Amazon's own brands are available for shoppers to choose from using different positioning. We have analysed the current competitive situation for the German platform in more detail and created a detailed infographic.

More...

The fact that retailers carry private labels in their assortments is not new, but standard in the retail world. In many cases, private labels have also evolved into a broad range of products that not only covers entry-level price segments - as REWE's portfolio shows,for example.

However, due to its market power, the potential of its own data pool and the consistency in its market cultivation, Amazon as an actual or potential competitor attracts particular attention and respect when the company enters a product category.

Amazon own brands - the status quo in Germany

In 2009, Amazon entered the race with its first own-brand offers. A lot has happened since then. Our analysis here focuses explicitly on product categories in which Amazon competes with brands for which Amazon is also a trading platform. We have therefore not considered products such as Amazon Prime Video, Amazon Fresh, Kindle or Alexa as own brands in this sense. Acquired brands such as Whole Foods are also excluded.

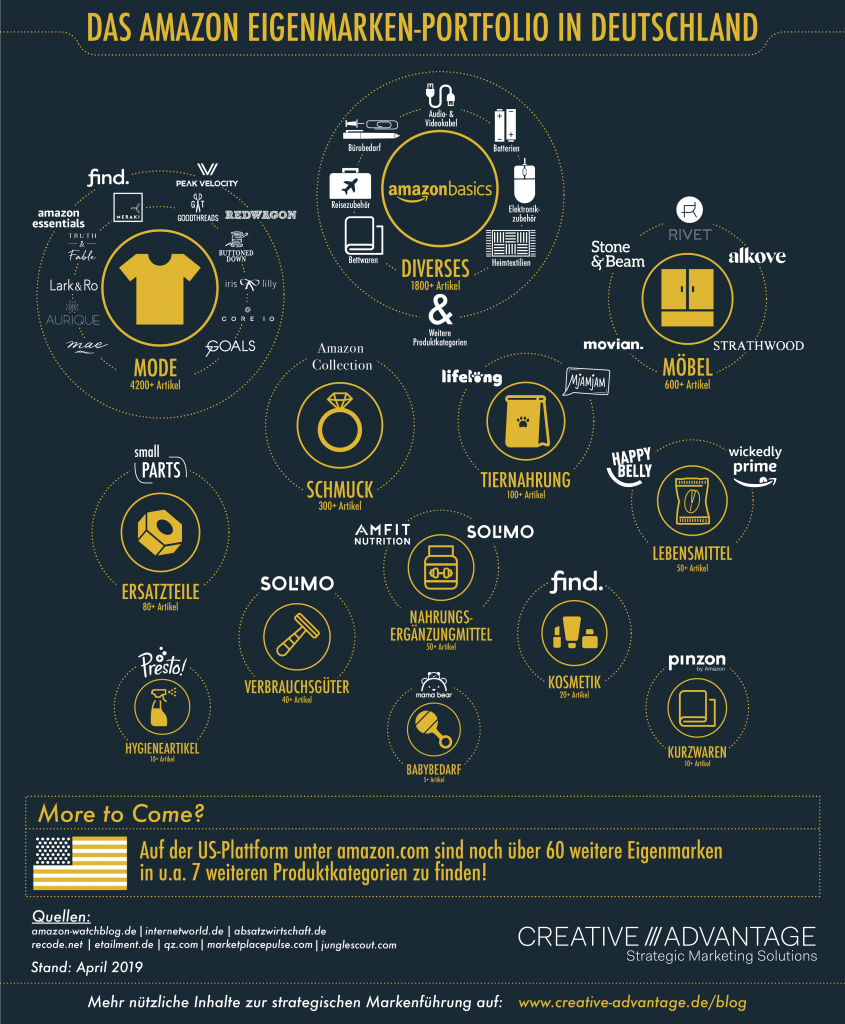

The following infographic provides an overview of Amazon's own brands on the German platform (amazon.de) in April 2019. Is your product category also included? The graphic shows in detail in which industries and product categories Amazon is currently active.

There is a lot going on in the Amazon own-brand universe. New brands are introduced, others fly under the radar. Do you have any additions or further examples? Feel free to share them with us in the comments!

Two focal points in the portfolio are clearly visible: The value brand Amazon Basics, which serves a wide range of categories and products (see next section), is still the most important. Fashion is a second focus, in which the brand portfolio is by far the broadest so far. In the other product categories that have been developed, there is usually a single brand, but often a high double-digit number of items are available.

Mainly still price beater

The most prominent own brand to date is Amazon Basics, which promises "high-quality products for everyday needs at low prices". The range is extremely broad: from the first product, batteries, to electronic accessories, audio and video cables, hoovers and "warm cuddly blankets". Together with jewellery under "Amazon Collection" and fashion under "Amazon Essentials", value-for-money offers still make up the bulk of the own-brand success.

For those who want to delve deeply into the significance of value brands in the Amazon brand portfolio, we recommend this detailed article by the e-commerce analysts at marketplacepulse.com.

A brand portfolio "always in beta

The Amazon ecosystem offers ideal opportunities for quickly testing brand concepts. Brands can be introduced easily via the company's own retail platform without having to worry about things like listings and shelf placement. Amazon acts accordingly "agile". Brands are often introduced quickly and often with little marketing support at first, but can disappear just as quickly if they fail. A look - e.g. here - at the US platform (amazon.com) shows an even greater breadth of own brands, whose international roll-out is certainly not unlikely if successful.

First variations in brand positioning

Amazon is now also increasingly developing brands that are distinguished by two things: The brand names do not include "Amazon" and the product categories are significantly further away from Amazon's technology expertise than many of the successful "Basics" products are. In addition, the USA is not always the launch market; brands can also appear first on the German platform, for example. The following examples represent this type of positioning of Amazon's own brands.

At the beginning of this year, the brands "Movian" and "Alkove" were launched in the furniture segment. The former is to be understood as a competitor to Ikea in terms of product design and pricing, while Alkove is clearly in the premium segment - including leather sofas for (regular) €2,000. Another interesting German launch is the pet food brand "Lifelong", which enters this very lucrative market segment with products for dogs and cats.

Brand launches like this show that Amazon is starting to positionits own-brand offerings in a more differentiated way. Price and product appeal are moving into higher-quality areas. However, Amazon still does not act like a classic branded company. Active brand communication is almost non-existent; for example, even for the premium furniture brand Alkove there is hardly more than a single landing page that allows visitors to roughly classify the brand. It is likely that the focus is primarily on platform-inherent mechanisms such as reviews and the discovery of articles via the product search.

Not every Amazon own brand has been a real market success so far. But precisely because of the unique conditions enjoyed by the e-commerce giant, it is important for brand owners to keep a watchful eye on this particular competitor.

Is your brand armed against current and potential competitors - like an Amazon private label? Use our Brand Positioning Canvas for an audit!